ny paid family leave tax withholding

The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14. Your insurance carrier may provide options for how you will be paid for example via direct deposit debit card or paper check.

What Employers Need To Know About Changing Paid Leave Laws Employee Benefit News

The contribution remains at just over half of one percent of an employees gross.

. No deductions for PFL are taken from a businesses tax contributions. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

2021 Paid Family Leave Rate Increase. Your employer will deduct premiums for the Paid Family Leave program from your. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross.

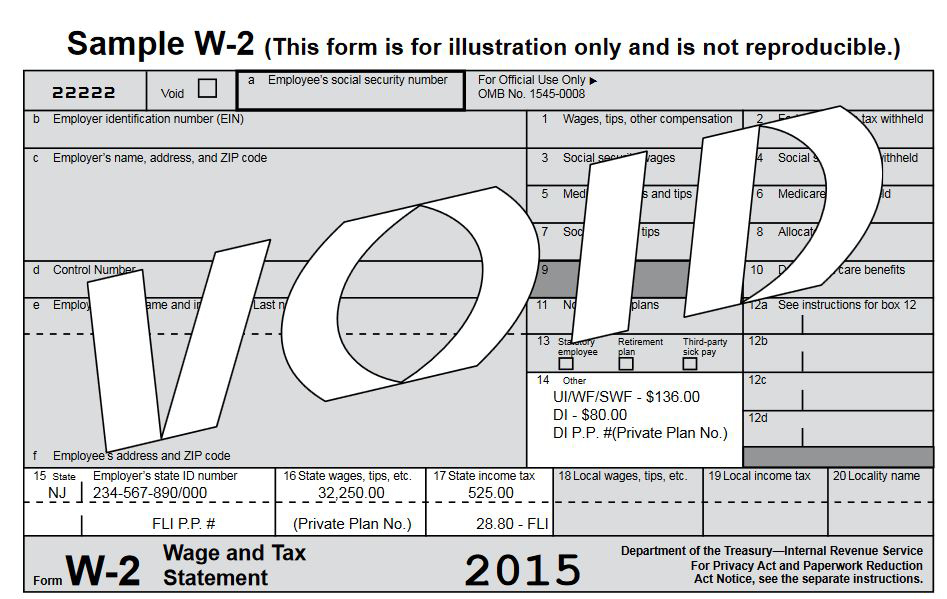

2 Collect employee contributions to pay for their. State governments do not automatically withhold paid. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form.

New York designed Paid Family Leave to be easy for employers to implement with three key tasks. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. For 2018 the annual cap is 8556 0126 percent of the annualized.

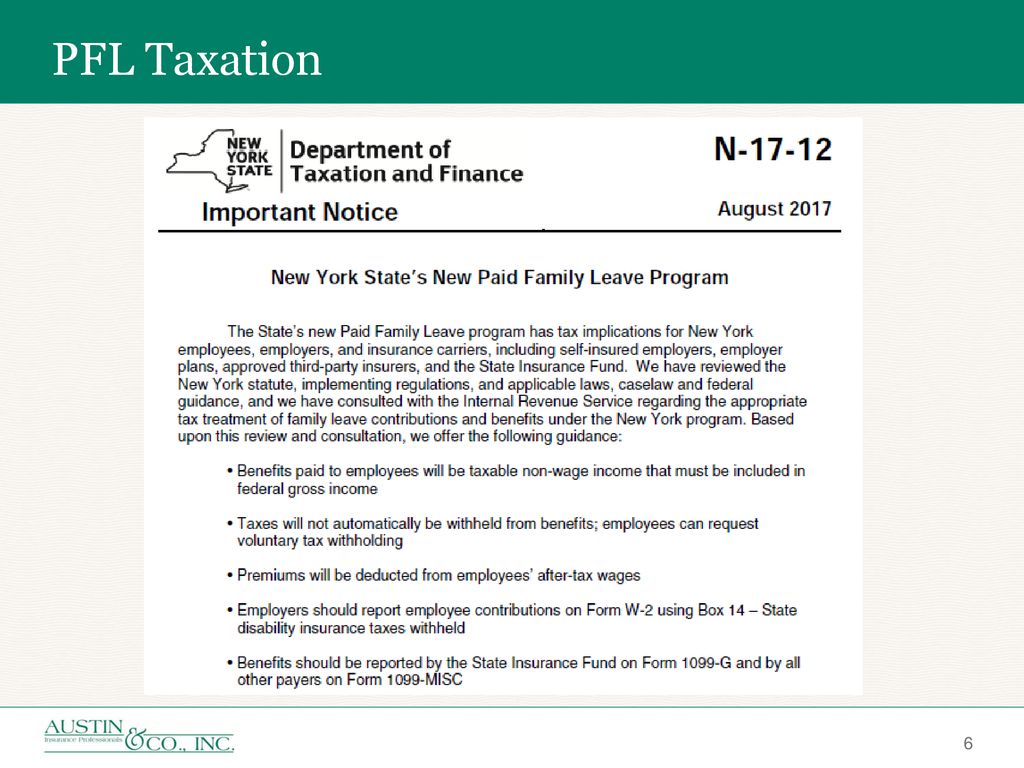

Pursuant to the Department of Tax Notice No. Wwwtaxnygov Withholding Tax Information. Employees can request voluntary tax withholding.

Increased monetary pay out a shorter waiting period duration to. Pursuant to the Department of Tax Notice No. They are however reportable as.

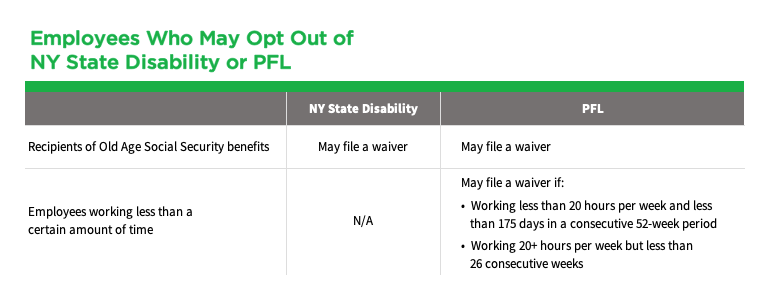

Enhanced Disability and Paid Family Leave Benefits. The program is effective on January 1. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

518-485-6654 Paid family leave In 2016 Governor Cuomo signed the nations strongest and most comprehensive Paid Family. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

The NYS Department of Paid Family Leave PFL has announced its 2022 contribution rates. 1 Obtain Paid Family Leave coverage. New York Paid Family Leave employer questions answered.

The maximum employee contribution rate will remain at 0511 effective Jan. 2022 Paid Family Leave Payroll Deduction Calculator. The New York Paid Family Leave Program was discussed in earlier posts on August 31 2017 August 17 2017 and June 29 2017.

2021 Paid Family Leave Rate. In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the. 518-485-6654 Paid family leave In 2016 Governor Cuomo signed the nations strongest and most comprehensive Paid Family.

Employers do not withhold taxes on an employees PFL benefits because they are not included in payroll. After discussions with the Internal Revenue Service and its review of other legal. An employer may choose to provide enhanced benefits such as.

For 2018 the PFL contribution rate is 0126 percent capped according to the New York State Average Weekly Wage. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Somers NY group insurance agency.

Now after further review the New York Department of Taxation and. The maximum annual contribution is 42371. New York paid family leave benefits are taxable contributions must be made on after-tax basis.

Paid Family Leave provides eligible employees job-protected paid time off to. Wwwtaxnygov Withholding Tax Information Center. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New.

The Paid Family Leave wage replacement benefit is also increasing.

Get Ready For New York Paid Family Leave In 2021 Sequoia

A Complete Guide To New York Payroll Taxes

Get Ready For New York Paid Family Leave In 2021 Sequoia

Nj Division Of Taxation Common Filing Mistakes

New York Paid Family Leave What You Need To Know For 2019

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com

7 Updates For New York State Paid Family Leave Burr Consulting Llc

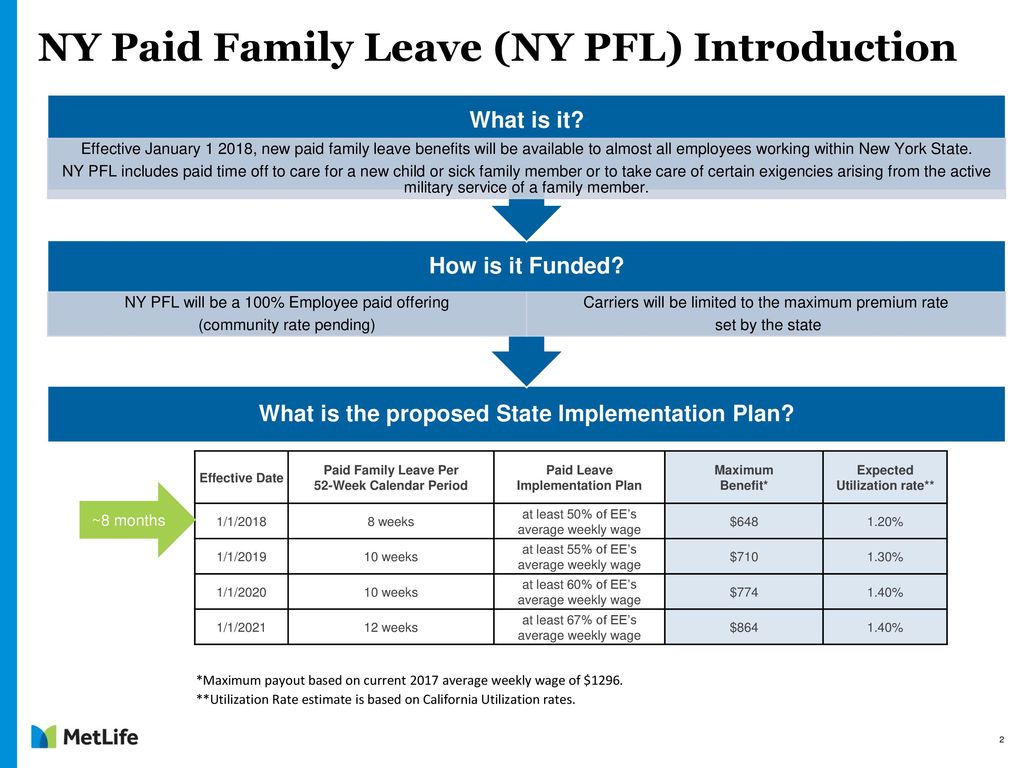

Nys Paid Family Leave Overview What We Know Today Ppt Download

Ny Paid Family Leave Customer Update And Feedback Ppt Video Online Download

New York Paid Family Leave Resource Guide

Paid Family Leave Expands In New York The Cpa Journal

New York Paid Family Leave Updates For 2021 Paid Family Leave

Paid Family Leave For Family Care Paid Family Leave

New York Paid Family Leave Resource Guide

Massachusetts Paid Family And Medical Leave